Why do your banking online?

Why do your banking online?

-

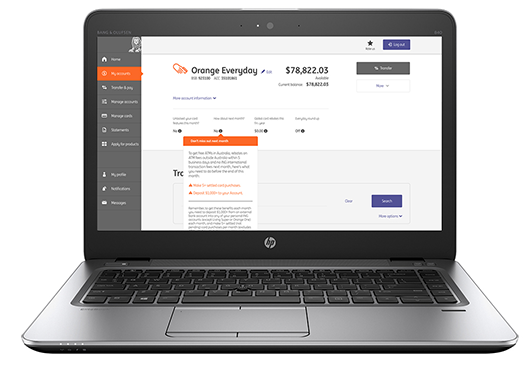

Get things done more easily

From finding transactions to accessing statements and getting a quick overview of your accounts, our site makes your everyday banking tasks so much easier.

-

Mobile, tablet and desktop friendly

Our site is super simple to use on all devices - desktop, tablet and mobile. For you, that means a seamless experience every time.

-

Secure

We make sure that security and fraud prevention measures are in place. Monitored 24/7.

-

New tools to keep you on track

We're constantly adding new features, allowing you to do more and more online. Send transaction receipts, change your access code, put your card on (or off) hold and more.